Peer-to-Peer (P2P) lending is a popular alternative to traditional financing methods. It is the process of obtaining financing from other groups of individuals — as opposed to a financial intermediary like banks, credit unions, credit cards, or payday lenders. It is also an effective way to (re)-build credit history and credit worthiness.

Canadian regulators have given the green light to P2P lending companies in 2020, which opened up the space for this alternative to traditional lending routes. The two main Peer-to-Peer platforms in Canada are Lending Loop (for small businesses) and goPeer (for individuals).

Peer lending has been around for about as long as banks have been denying loans to loan applicants (often blacks, indigenous, immigrants, and other marginalized demographics),

and forcing prospective borrowers to turn to people in their own communities, ROSCAs or saving/lending circles, for alternative financing. These are often run as informal collectives or cooperatives. #BlackSocialEconomyTheory

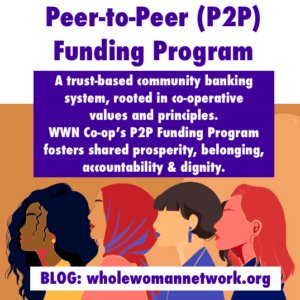

On January 2, 2024, Whole Woman Network Inc. Social Enterprise formally incorporated another distinct Cooperative entity – The Whole Women Network Worker Co-operative (WWN Co-op). One of the many benefits of becoming a member of WWN Co-op is access to our community-led “Peer-to-Peer Lending” and “Matching ROSCA Funds” Programs.

Our P2P program is anchored on: the principles of the solidarity economy and a unique cooperative model based on an indigenous Rotating Saving and Credit Association (ROSCA+). It connects members of the Whole Woman Network community looking for loans, with other members and/or investors interested in offering loans or investing.

Click Here to Read More About WWN’s P2P Funding Program.